CATL’s Recent Business Performance and Financial Health

inancial Status and Growth Rate

CATL (Contemporary Amperex Technology Co., Limited) has experienced rapid growth in recent years, and its latest full-year earnings report for 2023 reflects continued strong performance. The company reported annual revenue of approximately RMB 400.9 billion (about USD 82.8 billion), representing a 22.0% year-over-year increase. Net profit surged by 43.6% to around RMB 44.1 billion (roughly USD 9.1 billion), demonstrating not only top-line growth but also significant improvement in profitability.

Notably, the company’s net profit growth outpaced its revenue growth, indicating enhanced profit margins. This was largely driven by its core EV battery business, which recorded sales volume of 321 GWh—a 32.6% increase from the previous year. Despite rising raw material costs, CATL successfully passed on price increases to its customers, helping to maintain and even improve its margins.

Operating cash flow remained robust, reaching approximately RMB 92.8 billion in 2023, underscoring CATL’s strong cash position. Even with increased R&D investment—up from RMB 15.5 billion in the previous year to RMB 18.4 billion—the company maintains ample financial flexibility. On the debt side, there are no major concerns. CATL’s high equity ratio and substantial cash reserves (RMB 255 billion as of June 2024) affirm its solid financial foundation.

Market Share and Competitors

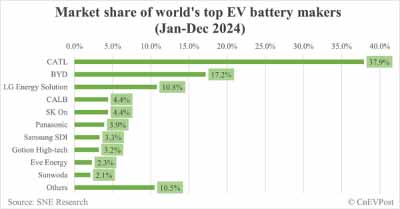

The chart for 2024 global EV battery market share shows CATL in a dominant position, commanding approximately 37.9% of the market. This is well ahead of competitors like BYD (17.2%) and LG Energy Solution (10.8%). All other manufacturers remain below the 5% threshold, highlighting CATL’s clear leadership.

According to SNE Research (South Korea), from January to November 2024, CATL held the largest share of global EV battery deployment at 36.8%. This is more than double that of BYD (17.1%) and LG Energy Solution (11.6%), confirming CATL’s near 40% control of the worldwide market. Its dominant presence is especially notable in China, where market share rebounded from 43.1% in 2023 (a slight dip from 48.2% in 2022) to 45.1% in 2024.

Key clients include global automakers such as Tesla, which alone accounted for 12.5% of CATL’s total revenue in 2023. CATL is also a leader in both major lithium-ion battery chemistries—NCM (nickel-cobalt-manganese) and LFP (lithium iron phosphate)—demonstrating competitive strength across the board. Given its commanding market position and product portfolio, CATL continues to maintain a significant edge over its competitors.